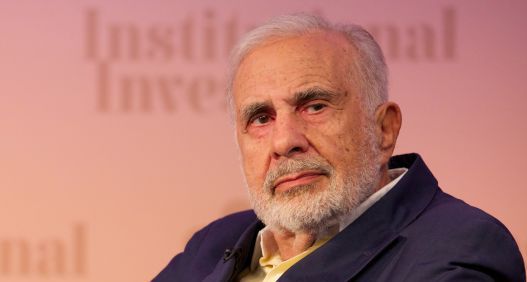

Carl Icahn Says Casino Giant Caesars 'Requires New Leadership'Billionaire Investor Takes 10 Percent Stake In Troubled Gaming Giant |

|

|

Through a filing with the Securities and Exchange Commission on Tuesday, billionaire investor Carl Icahn announced that he owns 10 percent of Caesars Entertainment Corporation.

Icahn wants to use that stake in the Las Vegas-based gaming giant to wield influence in the direction of the company, which he feels should result in a new CEO and/or a sale.. According to the filing, he wants representation on the board and wants to discourage them from appointing a new CEO in the immediate future.

“We believe that our brand of activism is well suited to the situation at Caesars, which requires new thought, new leadership, and new strategies,” the filing adds.

The current CEO of Caesars, Mark Frissora, was scheduled to leave his position in February, but the shareholders decided to extend his time in the role through April. Icahn doesn’t want Frissora at the helm any longer than that and is planning on nominating a list of candidates to take his place, if necessary.

Over the last few months, Icahn has been building a position in the company because he feels that the stock is undervalued. The founder and controlling shareholder of Icahn Enterprises believes that the best way to boost the value of the stock is to sell it.

Other major investors are onboard with the Icahn’s plan. Tilman Fertitta, another billionaire and owner of Landry’s Inc., which owns Golden Nugget LLC., reportedly bought 4 million shares of Caesars after hearing about Icahn’s stake.

Caesars has been approached twice by other casino operators with an offer to buy the company’s assets dating back to last year. Golden Nugget LLC and Eldorado Resorts Inc. both made offers. Both were rejected by Caesars shareholders.

The market reacted positively to the news of Icahn’s stake in Caesars. Since the announcement of the filing on Tuesday, the price of Caesars’ stock rose five percent. It’s up 42 percent this year but is still down 27 percent over the last 12 months.

Icahn has a history of success in selling gambling companies. Last year, he sold Tropicana Entertainment Company to Eldorado for $1.85 billion.

Caesars filed for bankruptcy in 2017, but has since recovered and is now just heavily in debt. The company has about $9.6 billion in debt, which is just less than half of the $25.6 billion in debt it held when it filed for bankruptcy about two years ago.

Any deal made by Caesars Entertainment would likely have little effect, if any, on the World Series of Poker. While Caesars owns the WSOP brand, it is under Caesars Interactive Entertainment, which was not involved in the bankruptcy proceedings.