Online Poker Likely Not the Answer for Nevada’s Widespread UnemploymentPossible that Silver State Casinos Could Keep Online Gaming Infrastructure Elsewhere, Outsource Jobs |

|

|

Poker has historically been somewhat negligible for Nevada brick-and-mortars in terms of revenue. In 2009, Nevada casinos took in $10.39 billion in win, with $145.6 million coming from poker — marking just over 1 percent of the overall take.

Poker has historically been somewhat negligible for Nevada brick-and-mortars in terms of revenue. In 2009, Nevada casinos took in $10.39 billion in win, with $145.6 million coming from poker — marking just over 1 percent of the overall take.

According to a University of Nevada Las Vegas Center of Gaming Research report, poker has, since 2006 — the year when Congress effectively ended the game’s surge in popularity with the passing of the Unlawful Internet Gaming Enforcement Act — become steadily less profitable for Nevada casinos. “The win per table has fallen dramatically to early 1990s levels,” however many casino operations still choose to provide them for their ancillary benefits.

During the height of the poker boom, which an American Gaming Association study concludes was 2004-5, a whopping 18 percent of Americans played poker in some form. U.S. casinos are looking to capitalize on an interest in the game that can flourish when the online version is running.

After the moves by the United States Department of Justice against the major offshore online poker sites, Nevada-based companies have a multi-billion-dollar industry open for the taking. Silver State government is gearing up to tax, while at least some portion of the 176,200 unemployed Nevadans are hoping for opportunities.

Will Players Just Stay at Home?

One of the arguments against online gaming is that Nevada tourism will drop, and with it brick-and-mortar staff. The casinos, however, believe they have a business model that will integrate web-based gaming with their traditional operations.

Las Vegas-based economist Jeremy Aguero told Card Player this spring that he doesn’t see a dip in tourists among the poker playing population because the digital rendition of the game has historically increased interest in attending, for example, live poker tournaments.

Las Vegas-based economist Jeremy Aguero told Card Player this spring that he doesn’t see a dip in tourists among the poker playing population because the digital rendition of the game has historically increased interest in attending, for example, live poker tournaments.

“Not only do people travel to those events to play, but they are also interested in seeing them,” Aguero said. “Most of the indication is that there will be an increased demand for services, not a decrease. In addition to that, the vast majority of poker play online is in micro-stakes games, which has always had an issue of liquidity surrounding it. Those micro-stakes games don’t compete with live game activities. The ability to leverage the Las Vegas brand — the brand of brick-and-mortar hotels and casinos — will have a substantial benefit for online poker in Nevada.”

The Las Vegas Review-Journal reported that industry experts at the Global Gaming Expo were mitigating fears by citing the potential of using online gaming for customer retention, offering players a product from their home, to the hotel room, and finally to the casino floor.

“In my personal opinion, the gaming licensees that we have are staffed with incredibly smart people, and the industry always finds a way to survive and reinvigorate itself,” Gaming Control Board member A.G. Burnett told Card Player. “They will probably have a lot of plans in place to dovetail Internet gaming with people coming to the properties. They will create synergies between the two in order to maximize their gain on it.”

While some critics may see the future of online poker as a battle between online and physical card rooms, the competition for online gaming is just as strong from TV and other websites as it is from traveling to a casino, according to University of Nevada Las Vegas economics professor Bernard Malamud.

While some critics may see the future of online poker as a battle between online and physical card rooms, the competition for online gaming is just as strong from TV and other websites as it is from traveling to a casino, according to University of Nevada Las Vegas economics professor Bernard Malamud.

The 43-year veteran at UNLV pointed out that online poker will always rely on the table-and-chair card rooms for at least one purpose: “You need casinos to give online gaming a mystique.”

How Much Job Creation?

The AGA estimates 10,000 new high-tech jobs nationwide from online poker, but views this as secondary to consumer protection.

A large chunk of those employment opportunities could be in Nevada. Aguero said back in March that an online poker system based in Nevada would generate about 1,200 direct jobs for the Silver State, with an undetermined number of indirect positions.

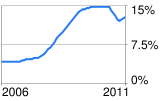

While any job creation is great news for many Nevadans, the relief could barely make a dent. As of August 2011, 13.4 percent of the labor force in Nevada was unemployed. The figure was slightly higher in the Las Vegas area, as 14.2 percent had no work — highest for any metropolitan area in the country, according to the U.S. Bureau of Labor Statistics.

While any job creation is great news for many Nevadans, the relief could barely make a dent. As of August 2011, 13.4 percent of the labor force in Nevada was unemployed. The figure was slightly higher in the Las Vegas area, as 14.2 percent had no work — highest for any metropolitan area in the country, according to the U.S. Bureau of Labor Statistics.

“An impact on Nevada’s unemployment is not likely,” Aguero said. “We have 180,000 people who are currently actively looking for work, so while it may provide opportunity for some of them it’s a pretty small share of the aggregate unemployed. In regard to [indirect jobs], we do think there would be some substantial spin-off effects of Nevada authorization and regulation of online gaming. This includes the technology itself, as well as banking related activity. One out of every $10 that is collected by an online poker operator is used for payment processing and financial transactions, and that is a substantial holding. We would expect substantial spin-off effects in that industry as well. Then you have all the ancillary technology such as age verification, security, all of those types of things, which Nevada could benefit from.”

Professor Malamud shares the skepticism for a potent increase in employment opportunities for residents. He pointed out that online gaming could play a role in an ongoing casino-construction hiatus that could last decades.

On the other hand, he said that since Nevada has a low cost of living, the Silver State may be an attractive location for companies associated with a developing online gaming industry.

While it’s difficult to predict which business sectors will benefit the most, the jobs most immediately affected by Black Friday and the ones that will return as soon as online poker comes back are of course for the professional poker players. The Poker Players Alliance claimed that were about 50,000 full-time online grinders prior to April 15, which represented a tiny percentage of the estimated 10 million Americans who had previously played the game for money.

With Nevada’s gaming industry employing about the same number of people in the state who are trying to find employment, an online gaming system is unlikely to be a long-term solution for solving the jobs crisis. Tax revenue and consumer protection from past alleged online poker crimes are the two pillars in the argument for regulation, while substantial unemployment relief remains to be visualized.

Who Will Get the Jobs?

Who Will Get the Jobs?

Right now it is unclear if jobs created from licensed and regulated online poker will stay in the Silver State, let alone the United States.

While Nevada officials are still drafting regulations for an interactive gaming system that would likely begin with poker, safeguards against major casino companies outsourcing jobs are not yet in existence. Although, Burnett said it makes sense for Nevada licensees to keep at least some of their Internet operating infrastructure in the state.

“Our agents theoretically might need to audit those functions, be able to visit those locations,” Burnett said. “I think it’s pretty safe to assume that the stuff will be located here. How much of it remains to be seen.”

Even if something is not explicitly written into the rules, the Board and the Gaming Commission still have options to secure infrastructure and its associated workers in Nevada. “There is always a possibility we could add that as a condition on their licensing approval,” Burnett said. “If it’s a public company, we can require it through their order of registration.”

Along with tech jobs to build and maintain the operating equipment of an online poker site, customer service will be another area of opportunity that could feasibly reside somewhere else.

Even though revisions to proposed regulations are ongoing, Burnett said that the real substance to Nevada’s regulatory authority will be put on when creating “minimum internal control standards” for licensees. Burnett added that when those are issued there might be some protection to keep call-center type jobs within Nevada and away from foreign countries, but he’s not sure which direction the Board as a whole might lean. Like the infrastructure dilemma, he said it would be something that state regulators would have the ability to control.

However, if an interactive gaming operator could show adequate protection and service for patrons, regulators would consider allowing the company to employ people in foreign countries. Each potential license is reviewed case-by-case.

However, if an interactive gaming operator could show adequate protection and service for patrons, regulators would consider allowing the company to employ people in foreign countries. Each potential license is reviewed case-by-case.

“I think obviously all Gaming Control Board members and Gaming Commission members want to keep jobs in the state, but when you look down into our job duties, it’s basically related to gaming regulations and companies that come here. If consumer protection and safety of the game are an issue at all, I would imagine the Board would require [certain jobs] be located here in Nevada. We don’t want our reputation to be soiled in any way.”

In terms of openings for Nevada public officials to regulate and inspect online poker systems, there likely won’t be any. The state budget deficit that online poker is expected to mitigate won’t allow for new hires in policing a newly regulated industry, according to Burnett. He said that Nevada’s current staff of employees is sufficient to serve the regulatory role.