A Look At State Dependence On Casino And Lottery Tax RevenueThe States That Benefit The Most From The Gambling Industry |

|

|

Budget shortfalls continue to climb into the billions of dollars for many states, so it’s no surprise that legislators are looking for ways to bridge the gap. One of the most popular methods of bringing in additional tax revenue over the past decade has been gambling expansion.

In the past year, a brand new casino industry emerged in Ohio and new properties continue to open and expand in North East states such as Pennsylvania and Maryland. Other states, such as Arkansas, Texas and Oregon, continue to press on in their effort to bring independent casinos to their residents. In the next few years, Massachusetts will throw their name into the mix with brand new casino resorts as well.

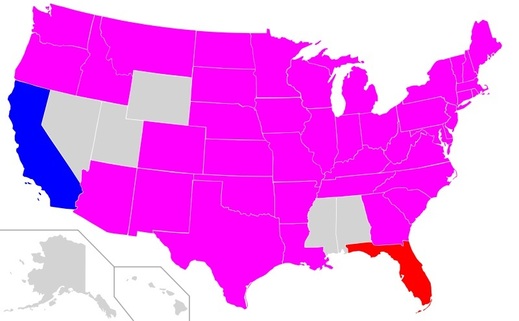

Additionally, a total of 46 jurisdictions offer some form of a lottery. These lotteries include popular games such as Mega Millions and PowerBall, but most states offer both. In 2010, the lottery industry nationwide was estimated to be worth over $62.85 billion.

In addition to online gambling, including poker, some states have also been looking at selling online lottery tickets or subscriptions. Illinois, Minnesota and Georgia have already jumped on board after the U.S. Department of Justice further clarified their stance on the Wire Act only pertaining to sports betting. Iowa, Maryland, New Jersey and New York have also looked into adding online lottery sales as well. Some states are also exploring the possibility of selling lottery credits in brick-and-mortar stores that can be redeemed online.

The below map shows the 46 U.S. jurisdictions that offer lotteries. Blue states have Mega Millions, red states have PowerBall and pink states have both.

There are currently 20 states that offer both commercial casinos (non-tribal) and state-run lotteries. This is a closer look at which of those states collect the most tax revenue from these offerings, including a look at the programs that are subsidized by them.

The King Of State Gambling Tax Revenue

The undisputed king of state gambling tax revenue is Pennsylvania, which boasts the biggest casino tax revenue at $1.456 billion thanks to a very high 34 percent tax on slot machines and a 16 percent tax on table games.

Of course, these numbers are also helped by the state’s take on lottery sales, which in 2011 came in at $1.02 billion. Pennsylvania is currently using 27 percent of lottery ticket sales to fund programs such as senior citizen centers, property tax rebates, low-cost prescription drugs and reduced-fare transit. Although the growing casino market is relatively new to Pennsylvania, having begun in 2006, the lottery has been around since 1972 having collected approximately $22.6 billion for the state.

One state that receives honorable mention is California, which took in $1.32 billion for public education programs in 2011 from lottery ticket sales and has collected over $25 billion since 1985. Because the state’s many tribal casinos and commercial card rooms don’t report gaming revenue, the full size of California’s take from the gambling industry can only be estimated somewhere in the neighborhood of $2.4 billion.

States Who Benefit More From The Lottery

Thanks to its massive population, New York ranks first in lottery tax revenue at $3.05 billion each year among U.S. jurisdictions with both a lottery and commercial casinos. Most of the funds are earmarked for education costs and make up 15 percent of the state’s total education budget. Since 1966, New York lottery tickets have funded the state with an additional $45.4 billion for education programs.

Though New York’s nine non-tribal racetrack casinos give the state a healthy $593.4 million annually, Gov. Andrew Cuomo is currently pushing for the addition of three upstate casinos to draw in visitor from neighboring states.

Other states with a big disparity between their annual casino and lottery tax revenue are Florida and New Jersey. In Florida, the state takes in a whopping $1.192 billion from the lottery, but just $143.6 million from their non-tribal commercial racinos. With the casino tax rate at 35 percent, many legislators feel the state would benefit from the addition of a Las Vegas-style casino resort, but pressure from tourism giants such as the Walt Disney company and the Seminole Indians, which operates seven tribal casinos, forced the idea to be shelved.

New Jersey’s 12 commercial casinos at one point made up the second largest gambling market in the United States, but Atlantic City has since been hit hard by the recession taking in only $3.317 billion in 2011, down from their peak of $5.217 billion in 2006. The end result is a reduced figure of only $277.6 million for the state thanks to a generous 8 percent tax rate. Meanwhile, the lottery helps to pick up the slack by generating $930 million for education programs. Atlantic City tried to get back on the right track with a new casino in Revel, but the property continues to struggle nearly one year after opening. Instead, Gov. Chris Christie may look to online gaming to save his once-thriving industry.

In 2011, Maryland took in $519.37 million from lottery sales, but only $89.53 million from casino tax revenue. This will change in 2013 now that gambling expansion has been approved by the voters. Now, the number of casinos will eventually grow to six, including a new property in Prince George’s County that will benefit gamblers from the Washington D.C. area. An industry that once consisted of two slot parlors, has now been expanded to include tables games and poker.

Though Illinois’ 10 riverboat casinos bring in a decent $489.42 million annually, the state fares better with the lottery, earning $690 million in ticket sales. Though there was a recent push for a land-based casino in Chicago vetoed by Gov. Pat Quinn, legislators have been looking at adding online poker to their Division of Internet Gaming, which oversees online lottery sales.

States Who Benefit More From Casinos

While the above states rely on the lottery to subsidize many of their programs, the following states are more heavily dependent on casinos. Louisiana, which collects $136.3 million from the lottery, gets more than four times that amount, $573.19 million, from their 18 riverboat and land-based casinos and racinos thanks to a 21.5 percent tax rate. The 20-year casino industry in Louisiana has been surprisingly recession proof in the last few years, holding steady with just north of $2.3 billion in gross gaming revenue annually.

Missouri has performed similarly. The 12 riverboat casinos pay 21 percent of their $1.805 billion annual gross gaming revenue to the state, resulting in $484.83 million for education and veteran’s programs. By contrast, the state only receives $271 million from lottery sales.

There are two states in the Heartland which also benefit more from their casino industry. The biggest of which is Indiana, taking $846.37 million from casinos and only $188 million from the lottery. Although casinos have performed reasonably well in the industry’s 18-year history, many Indiana legislators have begun to worry about decreasing gross gaming revenue numbers due to increased competition in neighboring Ohio.

Iowa has a modest $68 million take from lottery sales, but gets nearly five times that amount, $321.53 million from their 18 riverboat and land-based casinos and racinos. Though their casino industry can actually boast a slight increase in gaming revenue, legislators are still looking at online poker to help boost tax revenue by anywhere from $3 to $13 million annually.

Traditional Casino States With No Lottery

Nevada, which boasts the largest gambling industry in the U.S. with $10.701 billion in gross casino gaming revenue, surprisingly does not have a state lottery. With just a 6.75 percent graduated tax rate, the state only gets $865.25 million annually for general funds and education programs.

Mississippi, the fourth largest gambling market in the U.S. at $2.239 billion annually, also has no lottery. With just an 8 percent tax on gaming revenue, the state only took in $274.42 million from gamblers in 2011.

Here’s a look at the 20 states that collect both casino and lottery tax revenue.

| State | Casino Tax Revenue | Lottery Tax Revenue | Total |

| New York | $593.4 million | $3.05 billion | $3.643 billion |

| Pennsylvania | $1.456 billion | $1.02 billion | $2.476 billion |

| Florida | $143.6 million | $1.192 billion | $1.336 billion |

| New Jersey | $277.60 million | $930 million | $1.207 billion |

| Illinois | $489.42 million | $690 million | $1.179 billion |

| Michigan | $320.67 million | $737.6 million | $1.058 billion |

| Indiana | $846.37 million | $188 million | $1.034 billion |

| West Virginia | $406.46 million | $558 million | $964.46 million |

| Missouri | $484.83 million | $271 million | $755.83 million |

| Louisiana | $573.19 million | $136.3 million | $709.49 million |

| Rhode Island | $308.71 million | $354.86 million | $663.57 million |

| Maryland | $89.53 million | $519.37 million | $608.9 million |

| Delaware | $230.16 million | $269 million | $499.16 million |

| Iowa | $321.53 million | $68 million | $389.53 million |

| Colorado | $102.17 million | $113.4 million | $215.57 million |

| South Dakota | $16.36 million | $107.98 million | $124.34 million |

| New Mexico | $64.72 million | $41.3 million | $106.02 million |

| Oklahoma | $18.30 million | $69.4 million | $87.7 million |

| Kansas | $13.08 million | $72 million | $85.08 million |

| Maine | $29.06 million | $52.2 million | $81.26 million |

NOTE: All numbers are taken from the 2011 fiscal year. Casino tax revenue numbers provided by the American Gaming Association.